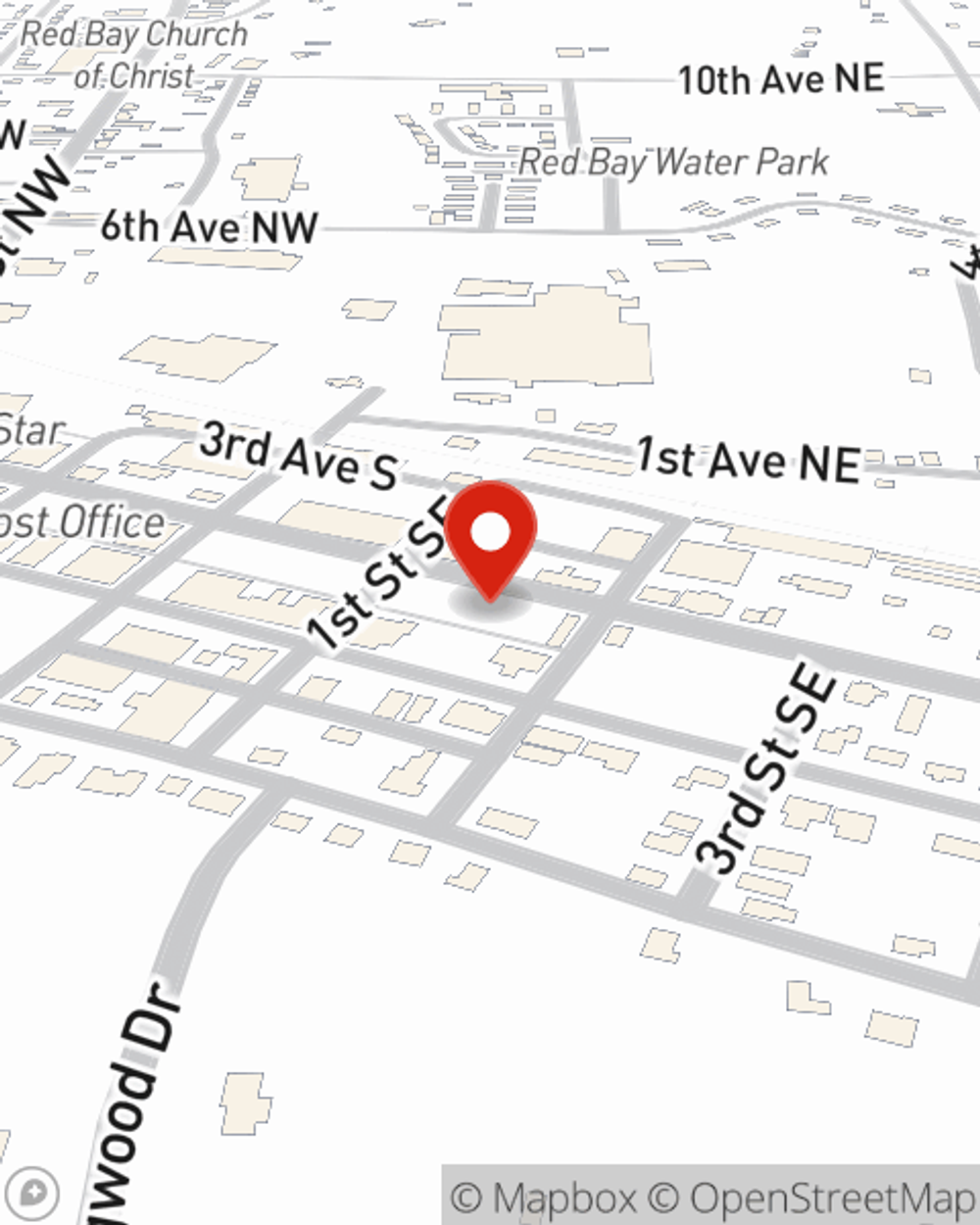

Business Insurance in and around Red Bay

One of the top small business insurance companies in Red Bay, and beyond.

No funny business here

Your Search For Remarkable Small Business Insurance Ends Now.

Do you own a photography business, an art gallery or a lawn care service? You're in the right place! Finding the right insurance for you shouldn't be risky business so you can focus on your next steps.

One of the top small business insurance companies in Red Bay, and beyond.

No funny business here

Insurance Designed For Small Business

You are dedicated to your small business like State Farm is dedicated to great insurance. That's why it only makes sense to check out their coverage offerings for commercial auto, commercial liability umbrella policies or surety and fidelity bonds.

Since 1935, State Farm has helped small businesses manage risk. Visit agent Ronald Thorn's team to learn about the options specifically available to you!

Simple Insights®

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Ronald Thorn

State Farm® Insurance AgentSimple Insights®

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.